Mass Adoption, and the S Curve

How it Relates to the TA of Bitcoin

In this next article in a series that delves into the nature of TA, I’ll look at that objection to TA’s applicability to Bitcoin, which involves trundling out the idea of mass adoption and the ‘S curve’. The idea being that with adoption by the masses, the S curve will blow up all Bitcoin price predictions of a more technical manner making any charts projection of price futile. Mass adoption, in this scenario, becomes a ‘weapon of mass destruction’ as far as charts are concerned. Yet it is the aim of this article to illustrate the complete opposite, that is, to show how relevant TA actually is to the S curve.

Most of us are familiar with the notion of the S curve. A new technology comes on the scene, there are early adopters, and after a passage of time adoption becomes a mass event. This applies to all forms of technology that have had an impact on the way in which we live our lives. The obvious example is email – with its advent only a few first used it, but over time is has been adopted by the mass of people. Being largely creatures of habit, the uptake of a new technology is at first slow [the bottom of the S], but as social animals also, the technology soon becomes ubiquitous as its convenience and efficiency triumphs over the old way of life [the vertical of the S]. And then eventually, a saturation point is reached where the curve plateaus out. As email went, so too - the argument of mass adoption goes - will Bitcoin. As applicable to Bitcoin, the idea is that price development, as it is currently being traced out on the chart, represents only a very small fraction [the bottom of the S], and that the significance of the chart would shrink in all proportion as prices go vertical with the uptake of mass adoption. In my opinion, this is to misunderstand the nature of the S curve. It’s the intention of this article to clarify what the impact of mass adoption, and the S curve, on a technical chart would actually be. My aim is to show that mass adoption is perfectly compatible with ongoing price development as charted by rational TA.

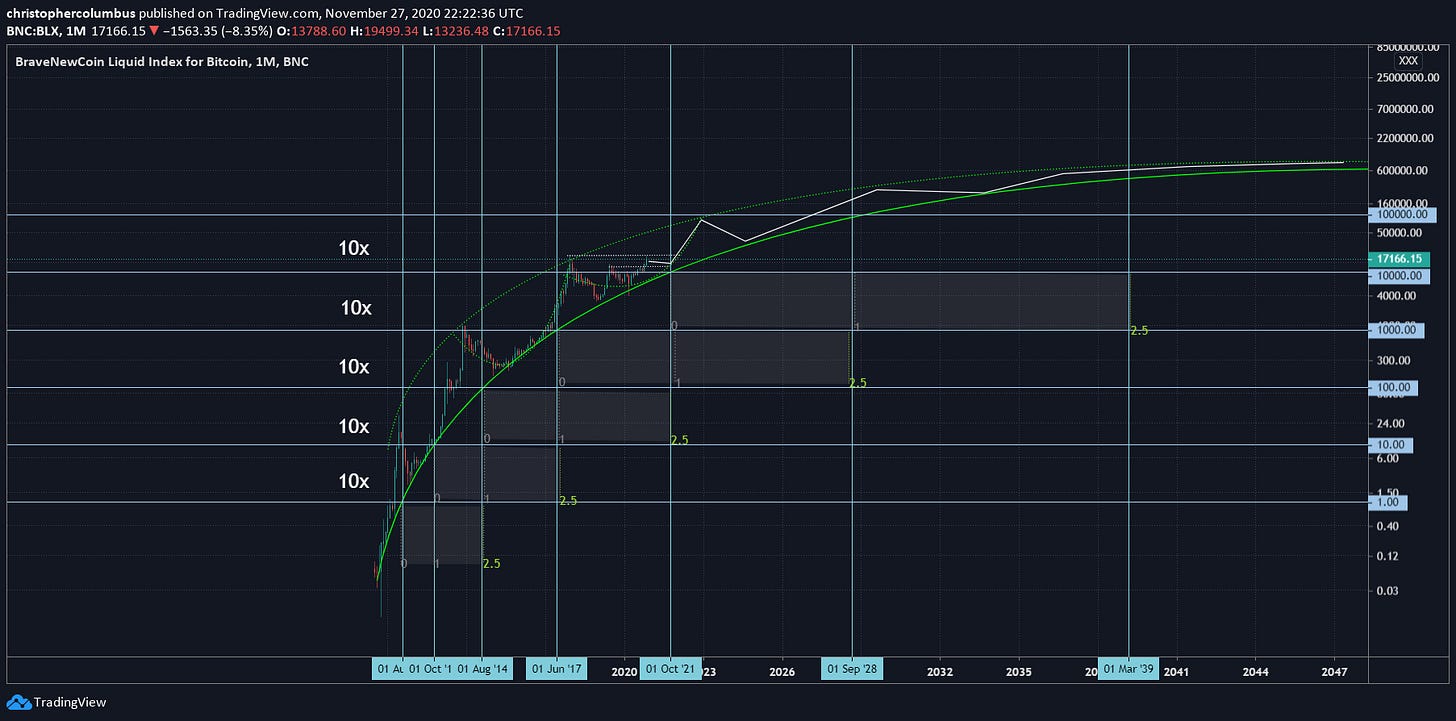

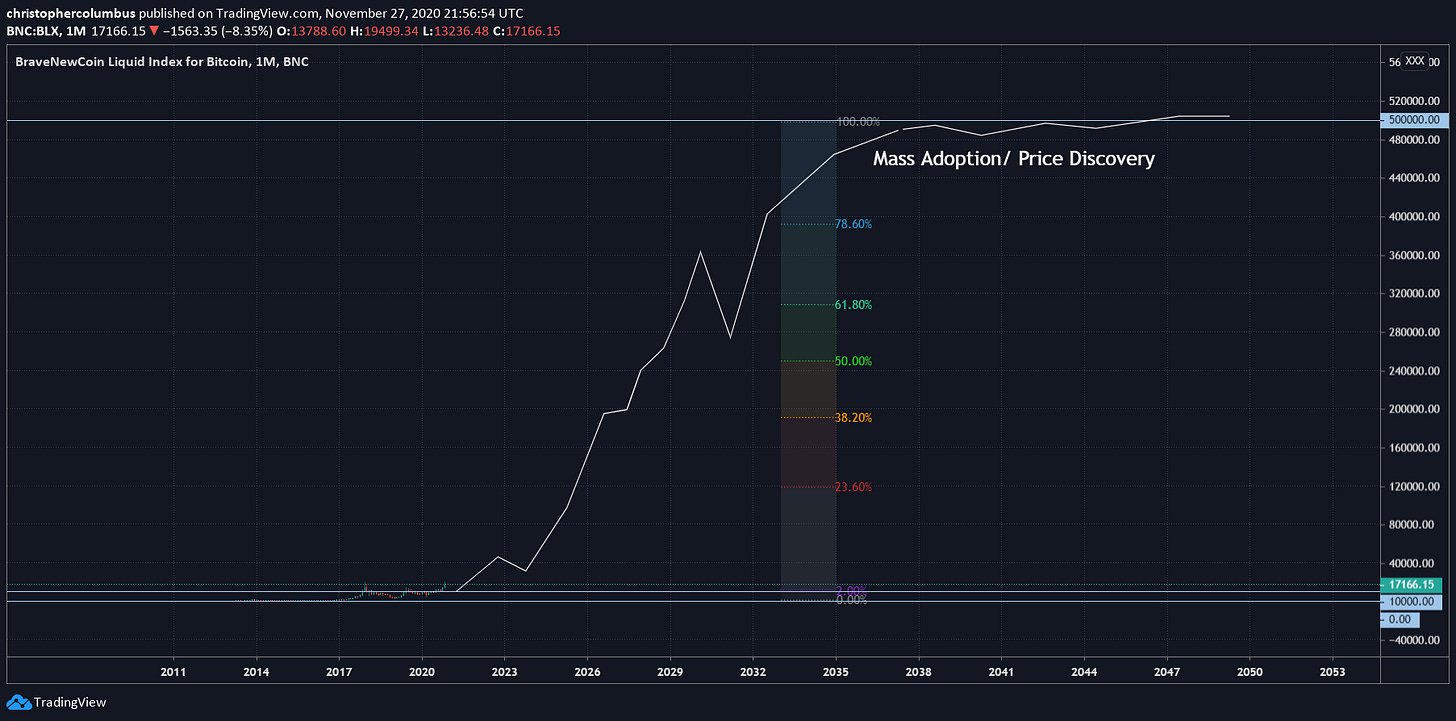

To begin with, the S curve can be charted despite what some would say. This is because with mass adoption you are dealing with 100% [or near 100%] of the population. Given this, you straight away have your y axis [the vertical]. It cannot go above 100 units, which must then be divided into equidistant parts. Each of these parts representing a percentage point. What follows is a provisional chart with the 100% metric to be used instead of price for the y axis [for now]. The metric of significance for the moment here is the 100% column not the prices. Notice it is also on the linear scale due to 100 equidistant parts representing percentage of population [this is one of the few times you’re obliged to use the linear scale with the Bitcoin price].

The next step is to find some correlation of these percentages with price. Though we don’t know yet what the ultimate price would be at 100% with mass adoption, there is a way to ‘reverse engineer’ this. If mass adoption is 100%, and if we say current early adoption is in the realm of 2%, we have something to work with. For from these two factors [2% adoption and current price] we might be able to extrapolate to what the price might look like at 100% adoption as per the next chart. Of course, TA is not asking for too much here, and certainly not certainty [check the ‘Nature of TA’ article], but it can sketch out some kind of a ball park figure.

Figure 3. Linear chart factoring in the 100% price based on current 2% adoption at a 10,000 USD price.

And as zoomed in.

The reader may be a little alarmed here as to my choice of 10,000 for current price, as opposed to the current 17,000 [which has just come off from 19,000]. The point here is to skim of the speculative froth, so to speak, and take the more solid price achievement at the base, as this chart [now in the log scale] illustrates.

And so we have the rationale for the projected price of 500,000 USD at mass adoption based on a current 2% adoption as charted in figure 3 above. The reader may be thinking that this is all very well, but all very speculative. And yes, it is speculation, but it’s also rational speculation based on TA - neither asking too much nor too little from it [see previous article - The Nature of Rational TA]. Perhaps if this sketch of a mass adopted price [otherwise known as price discovery] was found to correlate with the same price as arrived at by a different methodology, then this would add further substance to what has been arrived at thus far.

As previously mentioned, most BTC charts will be on the logarithmic scale due to the exponential movement of price. And so the next logical step is to transpose the chart on the linear scale to the chart on the logarithmic scale to see if they are correlated in some way.

And the same chart as translated to the logarithmic scale -

And sure enough, the two prices match up remarkably well on the two different scales. We can now see that the S curve IS the logarithmic growth curve. It becomes so by simply switching the linear scale to the logarithmic scale, and vice-versa - the log curve IS the S curve. This takes us back to figure 5 with the added price projections from the linear S Curve to the logarithmic Growth Curve.

If not proof [never look for ‘proof’], this correlation of price between the two scales simply serves to strengthen the case that has been outlined on the linear chart. And so we can see that far from blowing all charts up and proving inimical to TA, the S curve has itself in fact proven to be something of a buttress to the project of rational TA. The apparent ‘wildcard’ of mass adoption is itself adopted into the TA cause.

So much for the technicals of Bitcoin, which brings the S Curve back within its reach. The question now is what of the ‘marketing’ for mass adoption? Like any new technology, it is the function and convenience of the technology that leads to its adoption, not any underlying ideology that is thought to be part and parcel of it. Indeed, one could argue that the progress of technology has alwyas coincided with the diminishing of ideology. With this in mind, those looking to advance Bitcoin toward mass adoption would be best to focus on its monetary utility that fulfils a currently perceived need or lack. Sure, there will be a little theory involved here, but it hardly need entail more than an outline of scarcity and security. The whole superstructure of a cypher-punk anarcho-capitalist worldview, which may be fine for rallying the camp, would be entirely inappropriate for introducing the material benefits of Bitcoin to the masses. In short, Bitcoin is now in a maturing process where it becomes increasingly mainstream. Part of this process has to be one of outgrowing that fertile bed and hothouse of ideas, which has previously served it so well in enabling a nascent currency to gather its strength. But now Bitcoin has come of age and can walk on its own as a burgeoning currency in the marketplace. It’s no longer the interest of a clique, but become an intrigue to all. And of course, bitcoiners themselves must realize that for price to mature, Bitcoin must enter the mainstream. Time to let go, and let Bitcoin do its thing.